Trevali Mining Corp. (TSXV:TV) recently saw its Percentage Price Oscillator drop just below the signal line for shares. Investors may be watching these levels and tracking the stock for a possible bearish move.

A moving average is a tool commonly used by analysts. The moving average simply takes the average price of a stock over a given period of time. These are often used to indicate a stock that that is in a peak or trough, or even to assist traders to figure out support or resistance levels in the stock. Trevali Mining Corp currently sits at $0.97 for a 200-day moving average.

The company is looking at a -92.50 Commodity Channel Index – or CCI – over the past 14 days. The CCI can be used to evaluate stocks as a coincident indicator. When it reaches 100, the CCI shows strong price action and an uptrend. When the CCI drops below -100, it implies weak price action and may indicate a downward trend.

The Average Directional Index – or ADX – is a popular indicator. It is designed to measure trend strength and is popularly used with other indicators when investors develop a trading strategy. Trevali currently holds a 16.90 for the past 14 days. Values between 25-50 indicate a strong trend, values of 50-75 indicate a very strong trend, and values of 75-100 indicating an extremely strong trend. The ADX, by design, was created to measure trend strength, but it can be used in correlation with the Plus Directional Indicator – or +DI – or the Minus Directional Indicator – or -DI – to decipher trend direction as well.

The Williams Percentage Range can also be useful when looking at technical indicators. The Williams Percentage Range goes between 0 and -100 and is used to measure if a stock is oversold or overbought. In many ways, it functions as an upside down Stochastic Oscillator. Levels below -80 may signal a stock is oversold, whereas level above -20 may indicate a stock is overbought. A number of analysts also use the indicator to define trends or project potential price reversals.

The Relative Strength Index – or RSI – is an oscillator that measures the change and speed in a stock price. The system oscillates between 0 and 100. Originally developed by J. Welles Wilder, the RSI indicates an overbought stock when it rises above 70 and is considered oversold when it drops below 30. This indicator can be used to find divergences and failure swings, as well as for more mundane purposes like detecting general trends. The 3 day RSI is $32.13, the 7 day is $40.17, and the 14 day is $46.42.

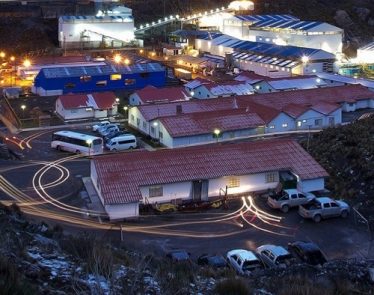

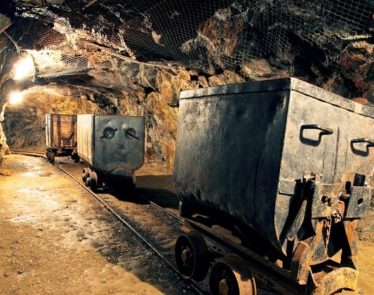

Featured Image: Depositphotos/© photominer